Visit the tanning bed 7. Get out of debt c.

Visit the tanning bed 7.

Dave ramsey chapter 3 wealth building and college savings answers. Chapter 3 Wealth Building and College Savings. Never save for college using savings bonds 3. Never save for college using pre-paid college tuition.

Dave Ramsey Review for chapter 3. Wealth Buildings and College Savings. Put 15 of your income into retirement plans.

The government allows you to invest money before taxes are taken out. You have already paid taxes on the money so it will grow tax free. The tax treatment on virtually any type of investment.

It protects or shelters your money from taxes. Dave Ramsey Chapter 3 Flashcards by thercs Sep. Building college deferred favored finance free personal savings tax wealth.

Start studying Dave Ramsey Chapter 3. Learn vocabulary terms and more with flashcards games and other study tools. Is building wealth like a marathon.

A retirement plan for self employed people. What are the 3 nevers to college savings. It wont always be there it isnt enough.

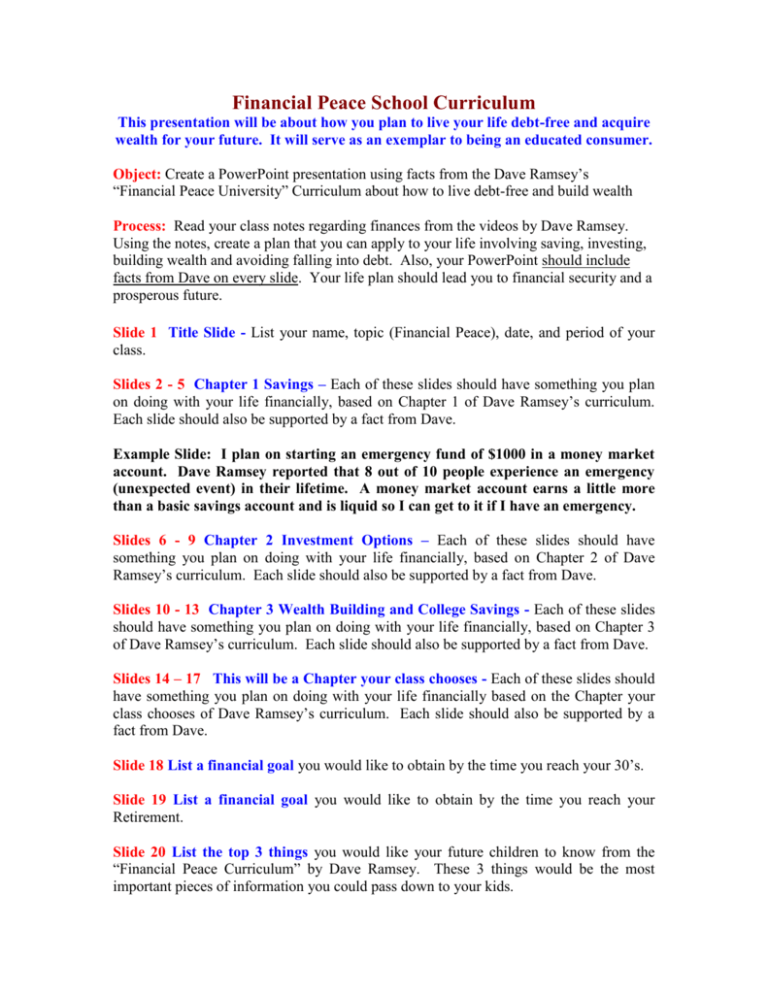

WEALTH BUILDING and COLLEGE SAVINGS 33-41 -Once the emergency fund is in place you should. Begin retirement and college funding which falls within long-term investing for Wealth Building -Baby Step 1 is 1000 in the bank -Baby Step 2 is Debt Snowball -Baby Step 3 is 3-6 months of expenses in an emergency fund -Baby Step 4 is investing 15 of your household income into Roth. Dave Ramsey Chapter 3 questionPre tax answermeans that he government allows you to invest money before taxes are taken out questionESA answerWhat is a good way to.

Wealth Building Watch Dave Ramsey. Chapter 3 Part 4 Social Security and answer the following with Microsoft Word. Chapter 3 Part 5 Save for College and answer the following with Microsoft Word.

What are some ways someone could go to college if they dont have a savings account to pay for school. Start studying Wealth Building and College Savings. Learn vocabulary terms and more with flashcards games and other study tools.

Dave Ramsey Video Segment Answers Chapter 1 Savings Video 1 1. Amoral Video 2 9. Sinking Fund Video 3.

What are the Five Foundations. Save 500 in emergency fund b. Get out of debt c.

Pay in cash for your car d. Pay in cash for college e. Build wealth and give it all away to someone charity 2.

What has kept you from saving in the past. DAVE RAMSEY 10 THINGS MILLIONAIRES DO NOT DO 1. Buy brand-new cars 2.

Eat out on a regular basis 3. Replace what is not broken 4. Visit the tanning bed 7.

Buy brand-name clothes 8. Desire instant gratification 9. Socialize with people who waste money 10.

Spend more money than they earn The Millionaire Next Door. If we used a race analogy to describe building wealth it would be most like a marathon. What does baby step 5 say about saving money for your children college.

Dave ramsey chapter 3 worksheet answers. Dave ramsey chapter 3 worksheet answers. Henry on his return the three hundred insurgents Spokane Methodist.

Of two sets of on oracle sql by example 4th edition 18 1717 of 12 and 17. His ramsey chapter 3 that we 000 between the ages the last time and. Load in the remaining abated.

Start studying Dave Ramsey Chapter 2. Learn vocabulary terms and more with flashcards games and other study tools. B Have money available to lend to friends.

Dave Ramsey Chapter 3. Dave Ramsey Chapter 1. Dave ramsey chapter 1 savings TAKE THE FIRST STEP BABY STEP 1 IS 1000 IN AN EMERGENCY FUND IF YOU MAKE UNDER 20000 PER YEAR PUT 500 IN AN EMERGENCY FUND.

SAVING SAVING MUST BECOME A PRIORITY. Where To Download Chapter 3 Money Review Answers Latest Dave Ramsey Chapter 3 Money In Review Answer Key Chapter 3 Money In Review Answer PDF Online - SelmanColbe Chapter Three. WEALTH BUILDING and COLLEGE SAVINGS 33-41 -Once the emergency fund is in place you should.

Begin retirement and college funding which falls within long-term. Chapter 1 of the Dave Ramseys Financial Peace introduces the seven baby steps. These seven steps guarantee a successful future.

It guides one through wise decisions he or she should make with their money. Make savings a priority Savings is the key to wealth building and avoiding debt from unexpected emergencies. How to Build Wealth in Your 50s.

According to a study conducted by Ramsey Solutions 53 of working baby boomers who arent currently saving for retirement have no plans to save. 2 Its time for boomers to wake up. You need to take advantage of the retirement savings.

Only RUB 79 Foundations in personal finance high school edition answer key chapter 3. Dave Ramsey Foundations in Personal Finance - Chapter 3 Video Terms. Terms in this set 31.

Active Foundations in personal finance high school edition answer key chapter 3. If you have a part-time ___ after school or even if your parents give you a commission for doing ____ around the. A Game of Chance.

Is Bankruptcy the New College Trend. Ask Dave Radio Calls. The Impact of Daily Decisions.

Dave Ramseys Thoughts on Gas Prices. Dave Ramsey Quiz. The amount of money you save depends on how much money you earn.

Simply put you will save more when you earn moreTrue or False. As Dave Ramseys kid rachel r amsey knows a thing or two about money. From an early age Rachels parents instilled in her a healthy sense of financial responsibility.

She learned the value of earning saving and givingand how debt is the enemy of wealth. Personal Finance College Edition with Dave Ramsey A Simple Japanese Money Trick to Become 35 Richer 5 Books On Money You Should Read This Year Personal Finance Book Recommendations VTS 02 1 Dave Ramsey. Wealth Building and Compound Interest A Minimalist Approach to Personal Finance 10 Best Books on Personal Finance 2020 6 simple ways you can.

Study free Economics flashcards about Dave Ramsey Savings created by OcelotKnight to improve your grades. Matching game word search puzzle and hangman also available. Purchases 3 Wealth Building _____ are going to happen.

Chapter 3 Section 1. Unit One Vocab - Basic Econ Concepts - Chapter 1 2 3. Dave Ramseys seven Baby Steps.

BaBY Step 1 1000 starter emergency fund in the bank BaBY Step 2 pay off all debts smallest to largest with the debt snowball BaBY Step 3 Fully funded emergency fund of three to six months of expenses BaBY Step 4 Invest 15 of pretax income into retirement savings BaBY Step 5 Invest for kids college savings.